colorado estate tax threshold

The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. Make sure you have engaged an attorney or CPA to limit any tax that you have to pay.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A federal estate tax return can be filed using Form 706.

. The answer is undoubtedly because it is cheaper and quicker. Plus that exemption is per person so a married couple. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

State wide sales tax in Colorado is limited to 29. Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment. Note however that the estate tax is only applied when assets exceed a given threshold.

In 2021 federal estate tax generally applies to assets over 117 million. Federal Estate Tax Exemptions For 2022. Essex Ct Pizza Restaurants.

The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to the modified federal taxable income. Colorado has no estate tax for decedents whose date of death is on or after January 1 2005. Land homes buildings etc and the decedents personal property must be less than 66000.

Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment. But when you add any local taxes they can get up closer to 8. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

13 rows Even though there is no estate tax in Colorado you may still owe the federal estate tax. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. They will average around half of 1 of assessed value.

But if its the decedent who has children from a past relationship the spouses share drops to the estates first 150000 and half the balance according to. The estate tax is a tax on an individuals right to transfer property upon your death. There are actually twelve states along with the District of Columbia that levy an estate tax and most have exemption amounts that are lower than the federal amount.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Whose tax payments may increase. The state of Colorado for example does not levy its own estate tax.

Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment. No estate tax or inheritance tax Connecticut. Opry Mills Breakfast Restaurants.

The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to the modified federal taxable income. But dont forget estate tax that is assessed at the state level. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023.

One of the new laws HB-1311 will eliminate certain state tax deductions for individuals and households with higher. The following are the federal estate tax exemptions for 2022. May increase with cost of living adjustments.

What is Considered a Small Estate in Colorado. Then you take the 1158 million number and figure out what the estate tax on that. Income Tax Rate Indonesia.

These values may also be impacted by gifts that you make during your lifetime. Currently about a quarter of states collect an estate tax. Estate tax applies at the federal level but very few people actually have to pay it.

The phase out of the state estate tax credit eliminated estate taxes for many states. The IRS exempts estates of less than 117 million from the tax in 2021 1206 million in 2022 so few people actually end up paying it. Most simple estates such as cash or a small amount of easily valued assets do not require the filing of an estate tax return.

For this the first 225000 of the decedents estate goes to the spouse as well as half of the balance. In Colorado a small estate is any. You would receive 950000.

A federal estate tax return can be. Married couples can exempt up to 234 million. Land homes buildings etc and the decedents personal property must be less than 66000.

1 Any funds after. For 2021 this amount is 117 million or 234 million for married couples. Property taxes in Colorado are definitely on the low end.

For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40. With a small estate probate assets can simply be collected by obtaining what is called a small estate affidavit essentially. Soldier For Life Fort Campbell.

That tax is levied after the money has passed on to the heirs of the recently deceased. The estate value is under the small estate threshold more on that below. Colorado Estate Tax Threshold.

Estate tax can be very complicated. And to find the amount due the fair market values of all the decedents assets as of death are added up. There is no estate or inheritance tax in colorado.

The state of Colorado for example does not levy its own estate tax. The Executor is formally granted authority to pay all debts and taxes the estate owes and he or she can then distribute the remaining value of the estate to heirs. Restaurants In Matthews Nc That Deliver.

For 2015 a filing is required for estates with combined gross assets and prior taxable gifts exceeding 543 million. The annual gift exclusion is 15000. Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value.

The estate would pay 50000 5 in estate taxes. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. Estate tax can be applied at both the federal and state level.

Individuals can exempt up to 117 million. For 2020 a filing is required for estates with combined gross assets and prior taxable gifts exceeding 1158 million. The state of Colorado for example does not levy its own estate tax.

To qualify for a small estate probate in Colorado the estate must not contain any real property ie. Delivery Spanish Fork Restaurants. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as of the January 1 assessment date. You would pay 95000 10 in inheritance taxes. Colorado Estate Tax Threshold.

However not many states have an estate tax. Do you make more than 400000 per year. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein.

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Colorado Estate Tax Do I Need To Worry Brestel Bucar

How To Avoid Estate Taxes With A Trust

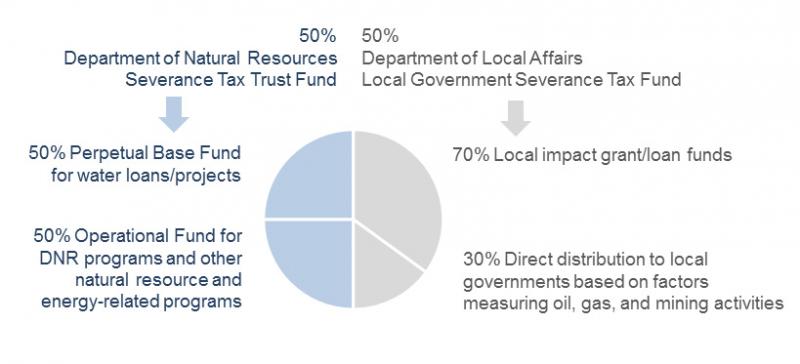

Severance Tax Colorado General Assembly

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

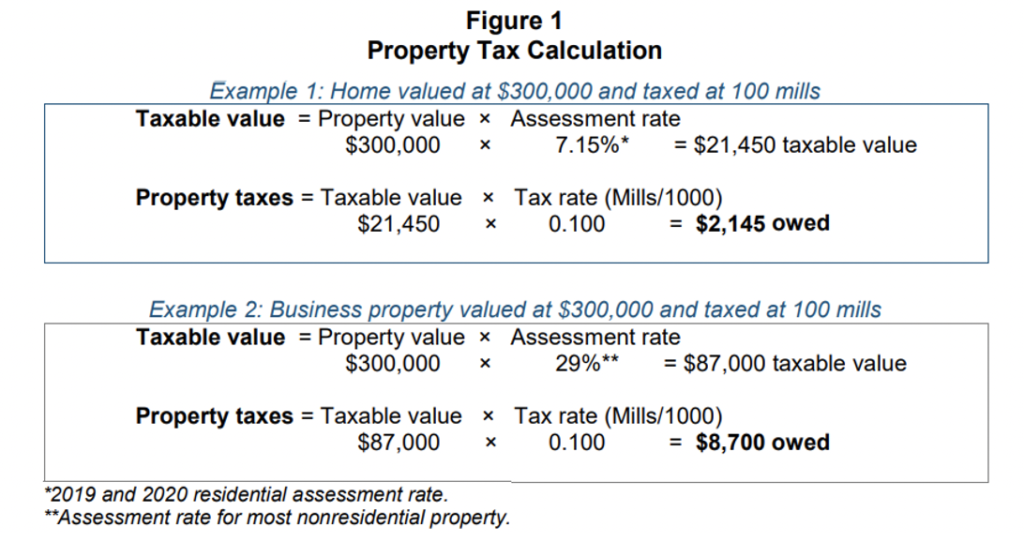

Property Tax Calculation Boulder County

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Individual Income Tax Colorado General Assembly

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Property Tax Comparison By State For Cross State Businesses

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)