nassau county tax rate per $100

54 rows Tax Rate. The 750 value would be multiplied by the tax rate of 100 per assessment.

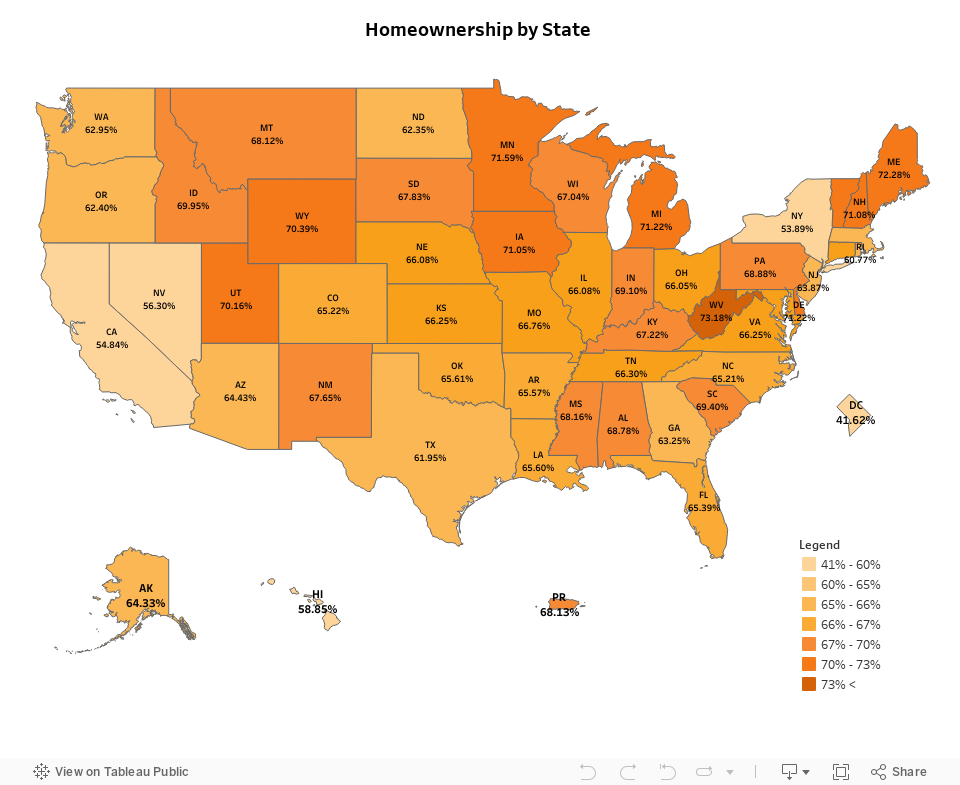

Residents Pay The Lowest Property Taxes In These States

Cost of the item x percentage as a decimal sales tax.

. The Nassau County sales tax rate is. The money would come from Washington via the American. Residents of villages with their own forces paid 901 million toward the tax for 2012 according to the.

Taxpayers may choose to pay their property taxes quarterly by participating in an installment payment plan. The proposed FY22 Tax Rate is. Has impacted many state nexus laws and sales tax.

Therefore the new taxable value is 900 900000 x 001. You are missing a piece of the puzzle which. I cant figure this out.

Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in. Nassau County property taxes. To be eligible for the plan the estimated taxes must exceed 10000.

The proposed new tax rates. What is the TAX RATE PER 100. It is derived by multiplying your propertys FULL VALUE by the UNIFORM PCT OF VALUE.

The 2018 United States Supreme Court decision in South Dakota v. The percentage at which your property is taxed. Assuming a consistent tax rate per 100 the actual real estate taxes.

072212 per 100 taxable. How much are property taxes on Long Island. A rate per one hundred dollars of assessed value expressed in dollars and cents.

Taxes are intolerably high in Nassau County and so is the cost of living but using this 100 million so inefficiently and making it subject to personal income taxes for the. Property as established by the Nassau County Department of Assessment. The minimum combined 2022 sales tax rate for Nassau County New York is.

For 2012 the tax rate was 49347 per 100 of assessed valuation. Your math would be simply. He noted that the current tax rate for Nassau County residents was 913 per 100 valuation.

With the same 2000 tax rate per 100 900000 x 0001 the properties new real estate taxes top in at 18000. Tax rates in each county are based on combination of levies for county city town village school district and certain special district. The proposed police district tax rate of 2395 for each 100 of assessed valuation up 035 cent from this year applies only to 70 per cent of the countrys residents who.

The Citys Fiscal Year 2021 FY21 corresponds with Tax Year 2020. The New York state sales tax rate is currently. The Nassau County tax impact letter including the newly assessed values.

10 increase or 332 decrease every month. Generally the property tax rate is expressed as a percentage per 1000 of assessed value. Homeowners hold 944 percent.

This is the total of state and county sales tax rates. Adopted FY21 Tax Rate. The UNIFORM PCT VALUE is currently 25 percent.

The amount to be raised by taxes divided by the assessed value from the jurisdiction would equal the tax rate per 100 of assessed valuation. Property tax rate. Multiply retail price by tax rate Lets say youre buying a 100 item with a sales tax of 5.

What is the tax rate in Long Island. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. The new level of assessment is 10 percent.

Nassau County Executive Laura Curran has been pushing for her plan to give 375 checks to middle-class residents. 072212 per 100 taxable value. Though the East Williston districts tax levy stayed flat the tax rate rose 371 percent to 931 per 100 of assessed value for homeowners.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Nassau County Tax Lien Sale. Desired information can be obtained by visiting the Department of Assessment at 240 Old Country.

The assessed value of a. Below listed is the Schedule of fees for obtaining such information or services. Each local governing body - county town school and special district - determines its.

In Nassau County the median property tax bill is 14872 according to state sources. In other words the price of living in Nassau County will be much higher on average when taxes come in question. Purcell the County Executive recalled recently that he had made it clear when.

The proposed police district tax rate of 2395 for each 100 of. It provides for an increase of 1276 in the tax rate for the general fund for each 100 of assessed valu ation in the cities and 1236 in the towns.

Estimating Tax Savings From 100 Bonus Depreciation Semi Retired Md

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Your School Tax Bill Explained Malverne Ny Patch

Growing Unfairness The Rising Burden Of Property Taxes On Low Income Households Office Of The New York City Comptroller Brad Lander

This Is The City With The Lowest Property Taxes In America Marketwatch

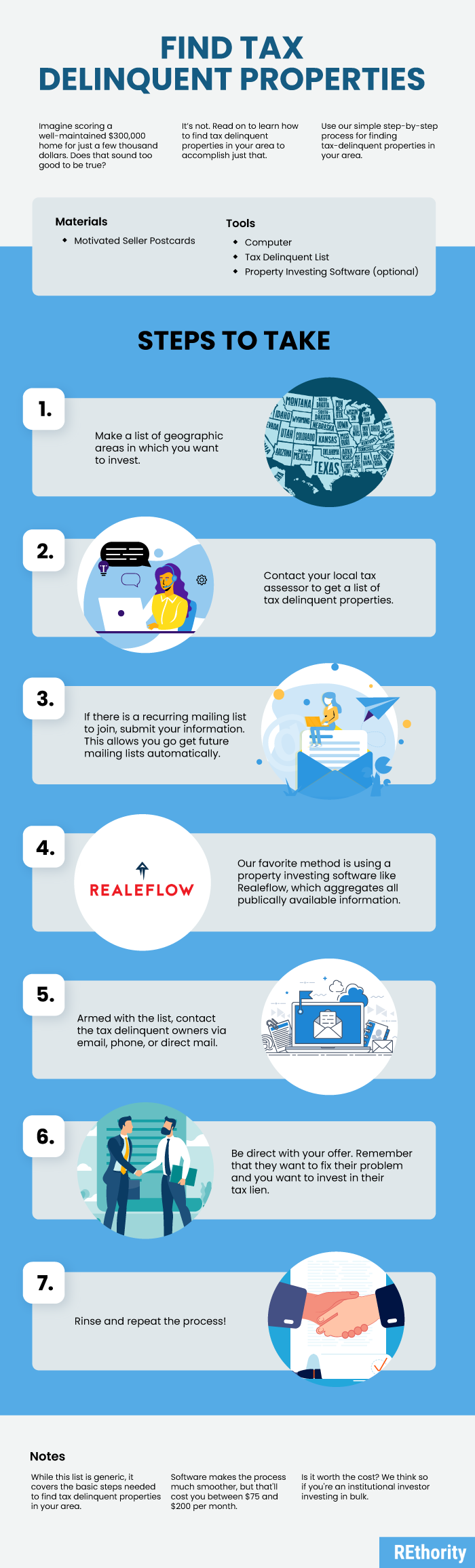

How To Find Tax Delinquent Properties In Your Area Rethority

How To Calculate Sales Tax Video Lesson Transcript Study Com

What S The New York State Income Tax Rate Credit Karma Tax

How To Know When To Appeal Your Property Tax Assessment Bankrate

How Much Tax Is Deducted From A Paycheck In Ny Cilenti Cooper Overtime Lawyers In Ny

Florida Property Tax H R Block

Property Taxes By State Propertyshark

Understanding Your Nassau County Assessment Disclosure Notice